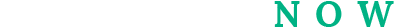

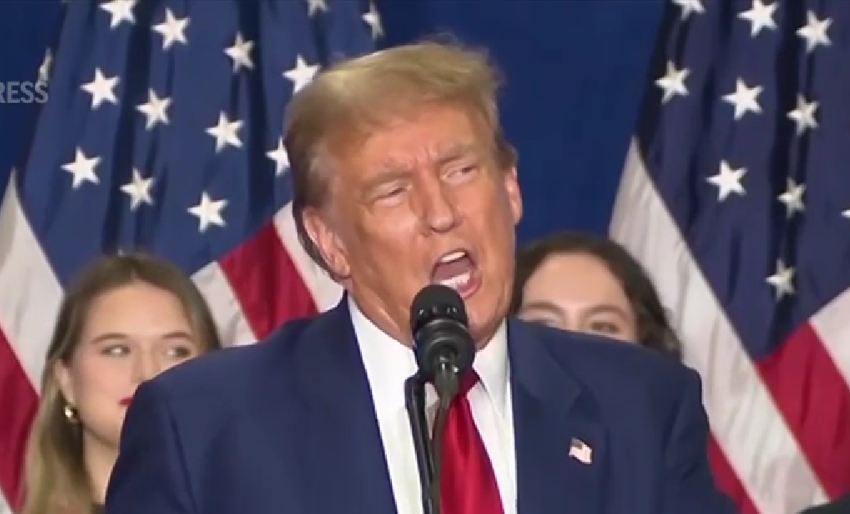

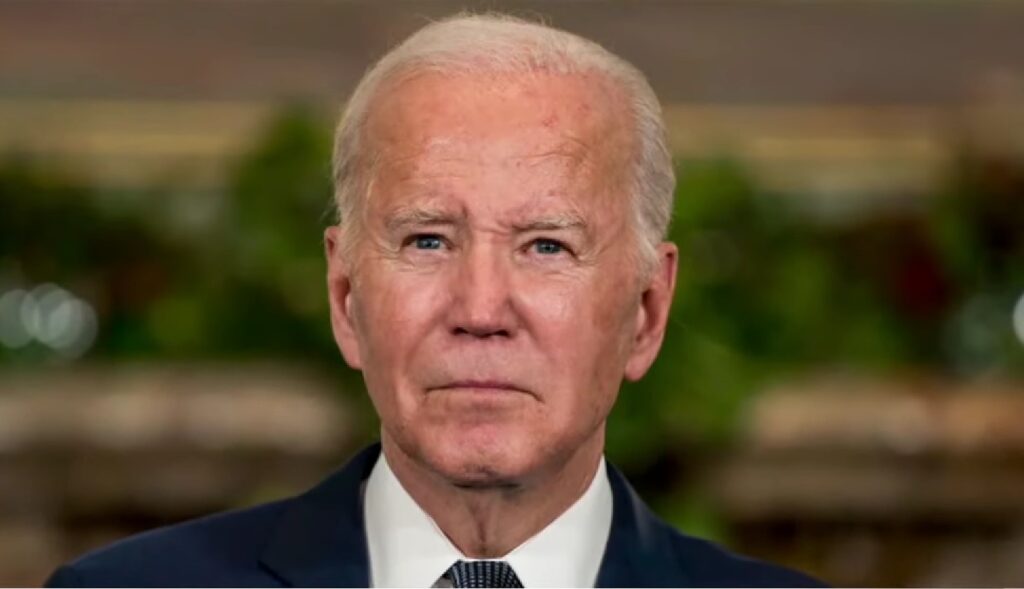

President Biden rolled out his latest plan to address student debt on Monday, marking a significant move less than a year after facing opposition from the Supreme Court over his previous attempt.

“Today, too many Americans, especially young people, are weighed down by insurmountable debts in pursuit of higher education,” Biden emphasized during his address in Madison, Wisconsin.

To ensure the durability of this relief package against potential legal challenges, the president has tailored the program to focus on specific groups of borrowers, particularly those grappling with financial hardship.

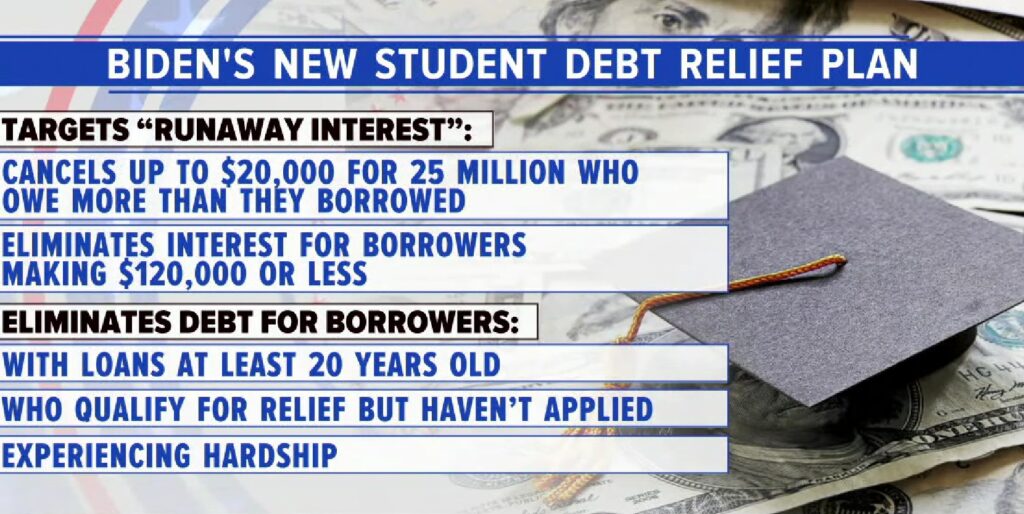

However, one key provision of the new plan could extend aid to as many as 25 million Americans by targeting the elimination of excessive interest charges.

Consumer advocates have long decried the exorbitant interest rates on federal student loans, which can surpass 8%, making it challenging for borrowers to make headway on their balances, especially if they fall behind on payments or are enrolled in certain repayment plans.

According to estimates from the Biden administration, more than 25 million federal student loan borrowers currently owe more than their initial loan amounts, underscoring the urgency of addressing this issue.

Under the proposed plan, borrowers stand to have up to $20,000 in accrued interest on their federal student loans forgiven, regardless of their income. Additionally, low- and middle-income borrowers earning less than $120,000 (single) or $240,000 (married) annually could have all accrued interest canceled since entering repayment.

While enrollment in an income-driven repayment plan is a prerequisite for eligibility, borrowers are not required to separately apply for relief.

“Student debt interest capitalization has been hindering families from achieving their version of the American Dream,” remarked Jaylon Herbin, director of federal campaigns at the Center for Responsible Lending. “Eliminating this debt will alleviate the burden of student loan debt for millions of borrowers and enable them to repay their loans in a timely manner.”

In addition to interest cancellation, Biden’s plan is expected to forgive the debt of specific groups, including those eligible under existing government programs, long-term borrowers, attendees of low-value institutions, and individuals facing financial hardship.

While the criteria for financial hardship have yet to be defined, it could encompass individuals burdened by medical debt or high childcare expenses, according to the Biden administration.

Initially pursuing student debt cancellation through executive action, Biden has shifted his approach to the rulemaking process. The next phase involves issuing a proposed rule on the plan, followed by a public comment period, with the aim of commencing debt forgiveness before the November election.